Black Entrepreneur Startup Program

We understand that starting your own business can come with its challenges, which is why we're excited to introduce our Black Entrepreneur Startup Program (BESP), funded by RBC. This program is specifically designed to support young Black entrepreneurs on their journey to success.

Funded by:

Additional loan financing from:

Funded by:

Additional loan financing from:

Our offering

Our team, who have their own lived experience, is here to guide you every step of the way. With BESP, you can access flexible financing, along with expert mentoring and other resources to help kickstart your business and make it thrive.

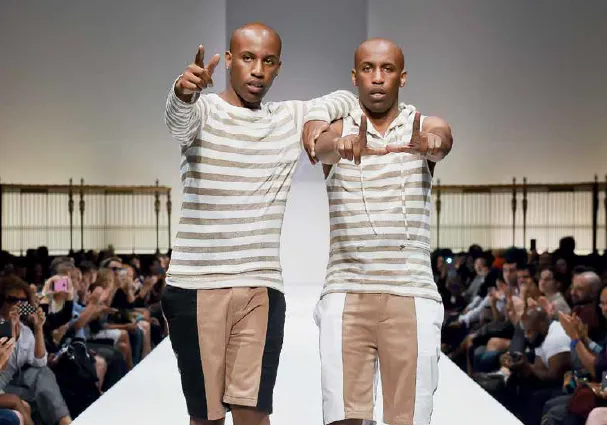

Shades Of Success: Episode 1

Michèle Pouani shares the story of KAMALI, a celebration of culture, beauty, and craft.

Are you eligible for the Black Entrepreneur Startup Program?

See here for the top level criteria you have to meet to be eligible or click the button to see the full list:

See full eligibility criteria hereYou must self-identify as Black

To participate in this program, participants must self-identify as Black. Intersectionality is also welcomed eg. those who identify as Black and Indigenous are also welcome to apply.

You must be a Canadian citizen or permanent resident aged 18-39

You must physically reside in Canada and be between the ages of 18 and 39 at the time of application.

You are looking to launch a business or have been operating your business for less than two years

In order to be eligible, your business must not yet be operational or can only have been operating full time for 24 months or less.

The business must be majority Black-owned

When there are only two partners (owners) of the applicant business, the business must be majority Black-owned (> 50%). When there are more than two partners (owners), the business must be at least 25% Black-owned (≥25%).

Visit our community pages

Learn what we've been up to and connect with the community!

Ingrid Broussillon

Griottes Polyglottes | Vancouver, B.C.

Become a community partner

Does your organization help young Black entrepreneurs launch businesses? Find out how we can partner with you to provide financing, mentoring and other resources to help them succeed. Call or email us today!

Arlene Ambrose

Arlene Ambrose Curated Health | Edmonton

Take a look at our other offerings

FAQ

Can’t find the answers you’re looking for? See our full FAQs.

To participate in this program, how is a person determined to be Black?

To participate in this program, participants must self-identify as Black. Intersectionality is also welcomed (e.g., those who identify as Black and Indigenous are eligible for this program).

Why does Futurpreneur have a specific program supporting Black entrepreneurs

Starting a business is challenging. Access to capital, financial literacy and unsatisfactory credit are just a few of the key barriers to success for many young entrepreneurs. The access to capital barrier, due to racism and systemic bias in the current financial system, along with business financial literacy are particularly acute for young Black entrepreneurs.

According to the Government of Canada’s fall 2020 consultations with the Black entrepreneurship community, “The issue of access to capital was identified by many participants as the most important issue for Black entrepreneurs. Participants noted that access to capital is crucial for any entrepreneur and that Black entrepreneurs have more difficulty than other entrepreneurs accessing capital.”

This is one of many statements about financing barriers faced by Black entrepreneurs from organizations, including Government of Canada, BDC, Canadian Black Chamber of Commerce, and others. Unfortunately, there is sparse data about the extent of this capital barrier, as most institutions do not collect demographic data about borrowers or credit eligibility.

In October 2020, Futurpreneur began collecting data about the barriers faced by our entrepreneurs in different communities, and the findings related to credit barriers are stark. Within the first three months of collecting data, only 17% of all entrepreneurs identified “bad credit score” as a barrier to their success; however, 31% of entrepreneurs who identify as Black identified “bad credit score” as a barrier—more than twice the 15% response rate of entrepreneurs who identify as White.

This is why, alongside mentorship and other supports, our Black Entrepreneur Startup Program includes more inclusive financing criteria for Black entrepreneurs, recognizing and addressing the impact of systemic credit barriers to their business success.

How is the Black Entrepreneur Startup Program different from your other programs?

At Futurpreneur we welcome aspiring, young entrepreneurs age 18-39 from all backgrounds to apply for support through our core Startup Program. Successful applicants receive up to $75,000 in loan financing (up to $25,000 from Futurpreneur and up to $50,000 from BDC) and up to two years of mentorship. They also gain access to a range of events, programs and resources.

Building on this program, we also offer the following initiatives:

- Side Hustle program: Sponsored by TD Bank, supports young entrepreneurs who want to launch or grow a part-time business, providing them with up to $25,000 in Futurpreneur loan financing, plus up to two years of mentorship and resources.

- Indigenous Entrepreneur Startup Program: Provides tailored support to aspiring, young Indigenous entrepreneurs. Delivered by an Indigenous team with lived experience, this program builds upon all the offerings of our core Startup Program, and also provides access to workshops and events led by Indigenous business experts, national networking opportunities and specialized resources.

- Black Entrepreneur Startup Program: Launched in March 2021, this program is delivered by a team with lived experience and builds upon all the offerings of our core Startup Program. Funded by RBC, with additional loan financing from BDC, it provides participants with $5,000 to $75,000 in inclusive startup loan financing and networking opportunities. It also offers the opportunity to apply for up to $40,000 in follow-on financing, funded by RBC, based on the first two years of successful business performance.

Financing terms & fees

Futurpreneur repayment terms & fees

- Up to $50,000 with a term over five years.

- Interest is charged at RBC’s prime rate + 3%. (Note that if RBC’s prime rate exceeds 6%, the interest rate charged is capped at 9%. If RBC’s prime rate exceeds 9%, the interest rate charged will be charged at RBC’s prime rate.)

- Interest-only payments for the first year.

- Principal repayments are made in equal monthly installments together with interest, over the remaining four years.

- No penalty for early repayment.

- A one-time loan management fee of 1% of the total loan amount is charged at the time of disbursement

- The above points reflect current Futurpreneur loan terms; the exact terms of each entrepreneur’s loan are clearly defined in their loan agreement.

BDC repayment terms & fees

- Up to $25,000 with a term over five years.

- Interest is charged at BDC’s current floating base rate + 1.65%.

- Interest-only repayment in the first year, commencing from the BDC loan authorization date.

- You may prepay all or any part of the outstanding principal, however, BDC must receive the interest owing to the time of repayment, together with an indemnity equal to three months’ interest on the principal prepaid.

- Once a year (non-cumulative), on the anniversary date of the loan authorization date, you may repay 15% of the principal outstanding without indemnity.

- BDC charges a $50 processing fee, which is deducted from the initial loan disbursement.

- Please contact your local BDC office for the BDC Floating Base Rate.