E05 Demystifying business loans: Why would I need them?

Tune into our new podcast, Startup + Prosper! Our podcast is dedicated to the key elements of the entrepreneurial mindset, with a particular focus on the current state of Black entrepreneurship in Canada. Each of the episodes aims to inspire and educate listeners about Black-owned businesses and their reality while providing more insight into Futurpreneur’s goals to grow, learn and help address the disparities faced by the BIPOC entrepreneurial community. Read their stories, listen and subscribe to our podcast, Startup + Prosper:

E05 – Demystifying business loans: Why would I need them?

What’s in a business loan, really? Kettie Belance, account manager at RBC― also an entrepreneur, professional singer, mother and all-around passionate person― gets to the nitty-gritty. Her role, she explains, is to provide guidance, backed by over 20 years of experience working at RBC and her own entrepreneurial journey.

“We need to make sure that our dreams come true”, said the account manager, after quoting Harriet Tubman, who famously said, “every great dream begins with a dreamer” . “Then, we must make it happen, and a great way to begin is to get help, and information on how to go about it.”

Lending a hand

A loan can open so many impactful possibilities for Black entrepreneurs. However, stigma lingers around borrowing money, credit, and the lack of financial literacy. “Knowledge is power” , declared Belance, who is committed to changing the mentality. “With that, you can make better choices, see for yourself, your family, and everybody around then you become an ambassador », she said.

And you don’t have to go through it alone. The account manager recommends getting the bank involved in the process as early as possible. « The earliest you get your banker involved, the earliest we can help you plan », she explains. Your financial partner can explain what is needed to get approval for a loan and how to go about it.

That’s not the only thing they can do for you. The advice comes in many forms. « Maybe I could advise you with an accountant, with somebody who does specialize in financial planning or investing, there are there are so many partners that can be part that could like surround your project the most of the people are not aware », she details.

Go and get it

Do you need money to make money? What you actually need is financing, explains Belance. « The business owner needs to have money that they s going to inject into the business », she explains, comparing it to a baby. That is where the loan comes in handy. « if someone else is going to give you additional capital you have to also show them how much you’re willing to put into your baby, your business, your dream. »

A loan is money you borrow from a financial institution. Your counsellor can advise you on the type and the terms if can take, and what is best for your situation. And there are so many options available. « That’s why I always refer back entrepreneurs to their bank because that’s where you get all the information for the multiple products that you can have access to », recommends Belance.

To apply for financing, there is a process. And it can take longer than expected, so to not let discouragement settle. « You have to be patient, and you have to make sure that the person that’s doing the loan for you, keeps you aware of what’s going on where we’re at », she says.

As you might expect, one important element to consider is your credit history. But that isn’t the full story. « It’s very important because you decide to do financing in the financial institution and they don’t know you, the only thing that they have is your credit bureau. », she explains.

But this alone should never stop you from applying. « it’s not because you have a credit bureau that is less credible that it means that it amplifies that you’re going to be rejected », Belance underlines. « It can be explained if we can do some research we can make it look better ». Things such as your experience as a business owner will also be considered — a key element that is not known to everyone.

In all cases, the thing to do is to make the step and get the information. if you do face rejection, it does not stop there. An account manager can give you advice about how to remedy.« So, therefore, the next time you apply, we’re gonna get it », encourages Belance. The most important thing is to ask why, then not settled in discouragement, and try again. And for entrepreneurs, rejection is part of the process. And there are options. «you’re an entrepreneur, you’re gonna go through stuff, you know, I feel like just build character. But it’s easier said than done.

RBC also recently launched a new financing solution called the RBC Black intrapreneur business loans. « RBC is committed to enabling growth and wealth creation for black entrepreneurs», states Belance. « The way that we want to do that is by giving access to capital, access to experts and access to engagement in the community. », The program has no age limit and offers up to $250,000 with advantageous rates.

To know more about how RBC empowers Black Entrepreneurs, you can visit the website , and listen to the podcast episode Demystifying business loans: Why would I need them? on Spotify and Youtube.

COVID-19: New Income Support for Small Business Owners and their Employees

Today, the Canadian government announced a new support package for Canadian business owners and their employees who are affected by COVID-19. The Canada Emergency Response Benefit (CERB) will replace two previously announced benefits, the Emergency Care Benefit & Emergency Support Benefit.

The CERB will give qualified workers who have lost income due to COVID-19, including those who have reduced work hours, are caring for ill relatives or are now staying at home to care for children, etc., up to $2,000 per month for up to four months.

Details to follow over the coming days.

What we know so far

How does the CERB help small businesses?

Workers affected by COVID-19–business owners and employees alike–will have extra support to cover lost income and meet their financial obligations.

According to the Prime Minister, workers who are still employed, but are not receiving income because of COVID-19-related disruptions to their work situation, will qualify for the CERB.

Who is eligible to apply for the CERB?

Any workers who do not qualify for EI are eligible to apply, including wage workers, self-employed and contract workers.

Should my laid-off employees apply for the CERB?

Any workers who are EI eligible and have applied to that program should not apply to CERB. This benefit is for workers who would not normally qualify for EI benefits.

Anyone who has applied for the previous relief programs (Emergency Care Benefit & Emergency Support Benefit) will be automatically migrated to the new benefit and does not need to reapply.

If I have to lay off my employees, what should they do?

Those eligible for EI should still apply for their EI benefits.

What if I need to reduce my employees’ hours after the benefit is rolled out?

The CERB will be paid every four weeks for up to four months until October 3, 2020. Employees who are affected by COVID-19 can apply to the benefit once their income is interrupted.

When will the CERB be available?

The government aims to have the application portal online by April 6. Once an application is received, the expected timeline for direct deposit to an applicant’s bank account is expected to be 10 business days.

COVID-19 Resources for Small Businesses

#cta-side{display:none;}

Last updated: February 26, 2020

With constant updates related to the COVID-19 pandemic, keeping on top of all the information available can be overwhelming, especially when you’re also trying to run a small business.

Our team has collected some details on the benefits and supports available to small business owners, as well as a number of helpful resources and guides. We will continue to update these resources with new information as it becomes available.

- Financial Support to Businesses and Workers

- Access to Capital for Small Businesses

- Business Development Bank Resources

- Government Tools and Resources

- Digital Marketing and eCommerce

- Supply Chain Management

- COVID-19 – FAQs

- Regional Support Programs

Government of Canada – Overview of COVID-19 Economic Support

Financial Support for Businesses and Workers

Canada Emergency Wage Subsidy (CEWS)

- Covers up to 75 per cent (as of December 2020) of an employee’s wages for qualifying employers. Note that benefit amounts vary depending on which time period you are applying for.

- Available retroactive to March 2020; available until June 2021

- In November 2020, the federal government announced a number of changes to the program designed to make it more accessible.

Canada Recovery Benefit (CRB)

- Provides $1,000 ($900 after taxes) per two-week period to employed and self-employed individuals not entitled to EI benefits.

- Administered by the Canada Revenue Agency

- Replaced the previously-announced Canada Emergency Response Benefit (CERB)

- Recipients must reapply for each period, and can apply for up to a total of 13 two-week periods (or 26 weeks) between September 27, 2020 and September 25, 2021.

Canada Emergency Business Account (CEBA)

- Provides small businesses and not-for-profits with interest-free loans of up to $40,000 to help cover operating costs. (In October 2020, the federal government announced plans to increase this amount to $60,000.)

- Repaying the balance of the loan on or before December 31, 2022 will result in loan forgiveness of 25 percent (up to $10,000).

- Businesses must have paid total employment income of between $20,000 to $1.5 million in 2019.

- As of October 2020, eligible businesses operating through a personal bank account will also be able to apply.

- Deadline to apply is March 31, 2021.

- Businesses must apply through their current financial institution:

Canada Emergency Rent Subsidy (CERS)

- Available to eligible businesses, non-profits or charities who have seen a drop in revenue due to the pandemic

- Directly available subsidy meant to help cover commercial rent or property expenses

- Eligible expenses can be claimed up to a max of $75,000 per business location or $300,000 for all locations

- Benefits available retroactive to September 27, 2020 and will extend until June 2021.

Regional Development Agencies (RDAs)

- Regional Development Agencies provide federal funding for tourism operators, small businesses or organizations.

- The Regional Relief and Recovery Fund (RRRF), implemented by the six regional development agencies in collaboration with the national network of Community Futures Development Corporations, supports businesses that are unable to access other government relief measures. For details, see the region closest to you:

Work-Sharing Program

- Helps employers avoid layoffs when there is a temporary decrease in business activity beyond their control.

- Provides Employment Insurance benefits to eligible employees who agree to reduce their normal working hours and share the available work while their employer recovers.

- A WS agreement has to be at least 6 consecutive weeks long and can last up to 26 consecutive weeks. Employers may be able to extend their agreements up to a total of 76 weeks.

Access to Capital for Small Businesses

Business Credit Availability Program (BCAP)

- Increases the credit available to small, medium and large Canadian businesses.

- Businesses must have been generating revenues for at least 24 months.

- Businesses must work with their existing financial institution to access it.

- If their needs exceed the level of support the financial institution is able to provide, the financial institution will work alongside BDC or EDC to access additional resources available under BCAP.

- Through BCAP, BDC and EDC will provide more than $65 billion in loans and other forms of credit at market rates to businesses with viable business models.

Farm Credit Canada (FCC)

- Provides additional financing for farmers, agribusinesses and food processors.

Purchase Order Financing

- Cover up to 90% of the purchase order amount to ease cash flow to your suppliers.

Canada Small Business Financing Program

- Easier access to loans for small businesses from financial institutions by sharing the risk with lender

- Up to a maximum of $1,000,000 for any one borrower

- financial institutions deliver the program and are solely responsible for approving the loan

Business Development Bank of Canada (BDC) Resources

Business continuity plan and templates for entrepreneurs

- Templates and tools to help entrepreneurs create and maintain their business continuity plans.

How to cope with the impacts of COVID-19 on your business (video)

- Advice for entrepreneurs on how to manage their business through this crisis period.

Well-being resources for entrepreneurs

- Resources intended to offer a range of services on mental health and well-being.

Best practices for the prevention of COVID-19 in the workplace

- A guide (PDF) summarizing practical advice for preventing the spread of COVID-19 in your business

COVID-19 business-planning tools for entrepreneurs

- Tools and tips to help you map out your next steps, identify new opportunities, mitigate risk and create resilience in your company, so you can emerge strong in recovery

Government Tools and Resources

- Use this interactive tool to determine which COVID-19 supports are available to you (includes programs and services offered by federal, provincial and territorial governments)

- Questions about federal financing options? Download the Canada Business App.

- Call to Action: Canadian Manufacturers Needed to Help Combat COVID-19

- Canadian Business Resilience Network: Offered by the Canadian Chamber of Commerce, these tools and resources are designed to help small businesses during COVID-19.

- Overview of Federal Government Services for Small Business web page highlights programs and initiatives for small businesses.

Third-Party Tools and Resources

Digital Marketing and eCommerce

- Facebook: Business Resource Hub

- Google Resources to Help Small Businesses Manage Through Uncertainty

- Shopify – COVID-19 Resources for Business Owners

- Shopify Short-Term Revenue Strategies for Brick-and-Mortar Retailers Navigating COVID-19

- GoDaddy: Take your Small Business Online: A Step by Step Guide

COVID-19 – FAQs

- For questions about rent payments, employee assistance, financing options and more, see the Canadian Federation of Independent Business (CFIB) COVID-19 FAQ.

Regional Support Programs

In addition to federal support measures, each region of Canada offers special support programs for small business owners.

- Alberta

- British Columbia

- Manitoba

- New Brunswick

- Newfoundland and Labrador

- Northwest Territories

- Nova Scotia

- Nunavut

- Ontario

- Prince Edward Island

- Quebec

- Saskatchewan

- Yukon

Alberta

Government of Alberta

City of Calgary

British Columbia

Government of British Columbia

British Columbia Chamber of Commerce

City of Vancouver

Manitoba

Government of Manitoba

Manitoba Chamber of Commerce

New Brunswick

Newfoundland and Labrador

Government of Newfoundland and Labrador

St. John’s Board of Trade

Northwest Territories

Government of Northwest Territories

Northwest Territories Chamber of Commerce

Nova Scotia

Government of Nova Scotia

Nunavut

Ontario

Government of Ontario

Ontario Chamber of Commerce

City of Toronto

Prince Edward Island

Quebec

Government of Quebec

Saskatchewan

Government of Saskatchewan

Yukon

Government of Yukon

Management Commentary on Financial Results for 2019/2019

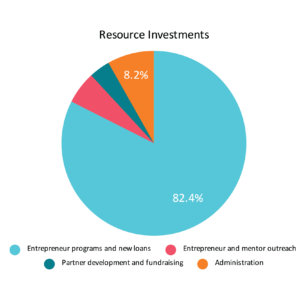

RESOURCE INVESTMENTS

At Futurpreneur, our priority is to support entrepreneurs across Canada – and to accomplish this we ensure our investments and resource allocations start with them.

Over the last three fiscal years, we have supported close to 3,000 youth-led businesses.

In fiscal 2019, new businesses that were financed through debt slowed a bit across Canada, due to rising interest rates and broader economic factors. Futurpreneur’s results also reflect this overall trend.

Futurpreneur ensures those who apply for our core Start-up Program will have access to support to start and grow their businesses. In our last fiscal year, those programs and supports represented 82 per cent of our total investment, while costs for administration were kept to 8 per cent and the remaining 10 percent was invested to build program awareness, outreach and fundraising capacity.

The average cost to deliver our core programs has increased in fiscal 2019 to reflect additional post-disbursement client support for our entrepreneurs.

More than four of every five entrepreneurs repay their loans in full, enabling their repayments to fund the next cohort of new business owners. We continue to provide strong support to our loan recipients for the five years their term loan is outstanding with us, providing flexibility to serve their needs with early redemption options and restructuring.

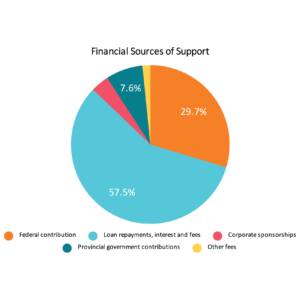

FINANCIAL SOURCES OF SUPPORT

While many not-for-profits are striving to retain current funders and identify new sources of support, Futurpreneur is prepared and well positioned to respond to ongoing demand for fundraising and partnerships. Our strength, in a large part, is due to our diversification in our sources of support. We don’t rely on any one source and have built a significant loan asset that is providing funds covering more than half of our annual cash requirements. We attract funders based on our ability to match and leverage their investments with other sources of support, and this is a strong differentiator of our model.

Several multi-year commitments for support from funders enable us to continue existing programs while also building out new resources and support to help businesses start and position for growth. To ensure a growing number of entrepreneurs will have access to loan capital, we also have a line of credit with the Business Development Bank of Canada, solely for the purpose of supporting young entrepreneurs with access to loan capital that exceeds other internal resources and sources of funds. Additional funds from the line of credit were not required in fiscal 2019, with only $4.3 million drawnat March 31, 2019 of a potential $8 million available.

Are You at Risk of Mortgage Fraud? What Entrepreneurs Need to Know

Rising interest rates and the new federal government “stress test” are making it harder for Canadians to save enough for a down payment or qualify for a mortgage compared to last year.

As a result mortgage fraud may be on the rise. A recent Equifax Canada study found that the incidence of mortgage fraud has risen 52 per cent since 2013, and that 67 per cent of all fraudulent mortgage applications in Canada originate in Ontario.

Homebuyers aren’t the only ones who commit mortgage fraud; professionals in the home buying process can profit by taking advantage of anxious buyers.

Mortgage fraud has many different faces, but generally it occurs when someone, such as a homebuyer, a mortgage broker, a real estate agent or a lawyer, misrepresents, intentionally withholds facts, lies or exaggerates information to obtain a mortgage that would not have been granted if information had been accurate.

Self-employed, independent contractors, business-for-self, part-time and temporary workers are at greater risk of mortgage fraud.

That’s because it’s often more difficult for them to prove their income, employment status and employment length, as they may not have access to the traditional proof of income documents such as pay stubs and a letter of employment typically provided by an employer.

Independent contractors, business-for-self and self-employed workers particularly, have more difficulty showing the viability and stability of their income source from the past two years. In cases where these workers are not able to provide satisfactory income proof, the impulse to fake or falsify these documents, either themselves or alongside a home buying professional, might lead to trouble.

Protect Yourself

Self-employed, independent contractors, business-for-self, part-time and temporary workers can take steps to protect themselves and ensure they get off to the right start in their new home.

- Familiarize yourself with the mortgage application process, so you know what to expect.

- Be sure to shop around for a mortgage, so you find the most suitable mortgage option for your needs and lifestyle.

- Consider using a licensed mortgage professional to help you understand your mortgage options.

- Make sure you complete the mortgage application carefully and check that all the information is correct.

- Get everything in writing and get copies of all signed documents.

- Don’t submit fake paperwork to get approved for a loan, even if a home buying professional completes the paperwork.

- Don’t trust a verbal offer for a loan, with no documents to back it up.

- Beware of being offered money to choose a certain lender or broker.

- Don’t pay cash for anything in the home buying process. All payments should be by cheque or other payment method that isn’t cash.

- Make sure you receive a lender-stamped commitment letter that has the lender’s logo and explains the conditions of the mortgage, and that you’ve complied with all conditions such as getting a home appraisal at least two weeks before closing.

- Don’t allow anyone to pressure you to sign a mortgage contract before the 48-hour “cooling off” period. You may choose to waive the “cooling off” period if there is less than 48 hours available.

- Ignore “too good to be true” offers – promises that you can get a bigger loan or a low interest rate, especially if you’ve already been declined by other lenders.

- Get an independent lawyer to review everything.

Be aware of the consequences

If you commit mortgage fraud, there may be serious consequences. If you’re caught before the mortgage loan is advanced:

- you may have already left your former home, and now you don’t have a home to move into.

- the lender could cancel the loan, which could cause the seller to sue you or you could lose your deposit.

If fraud is detected after you have the home:

- the lender has the right to “call in” the loan and require you to pay the whole amount of the mortgage immediately. If you can’t pay, you will lose the home through foreclosure or power of sale.

- your credit score will be damaged, making it very difficult for you to get a mortgage or other loan in the future.

How to report possible mortgage fraud

If you suspect fraudulent mortgage activity, first report it to your local police or the Canadian Anti-Fraud Centre. If you wish to remain anonymous, you can submit a tip to Crime Stoppers.

You can also report suspected mortgage fraud to FSCO. To learn more about mortgage fraud and how to report it, visit www.fsco.gov.on.ca/mortgage-fraud.

Article provided by the Financial Services Commission of Ontario.

Sources:

Equifax Canada, January 2017. Mortgage Fraud on the Rise; 13% of Canadians Say ‘a Little White Lie’ is Okay to Get the House You Want.

Tools & Tip: How Difficult is it to Find Financing for your Business Project?

While many entrepreneurs easily find a way to self-fund their business project from the get-go, it’s inevitable they will eventually have to inject additional funds into their project at one point or another. Financing is a key step for a start-up. It divides up stillborn project from those who will surpass the crucial five-year mark. That said, many entrepreneurs see financing as quite the puzzle and have a lot of questions that stay unanswered.

How can I get financing for my project? Who should I apply to for financing, and how to go about doing that? How do I convince funders to get on board? If I get declined, is it a definitive answer? What can I do to prepare myself well before starting the process?

In the end, is it that complicated to get financing for your project? The answer to that is: NO!

I assure you, the process is actually a lot simpler than you think. To help you with this crucial stage in your business launch, here are a few tips.

Know your project cost inside and out

I’ll never say this enough, the entrepreneur needs to become an expert when it comes to his or her project cost. As the architect of their business project, they are the only one who can speak to its overall cost. More importantly, the entrepreneur should be able to explain their project cost in detail. There’s the key, really! But why is it so important to know your project cost in detail? For two main reasons. First, funders will want to know how the funds will be used. In other words, they will want to understand how their money will be spent. It is important to understand that certain funder have restrictions when it comes to what they can and what they cannot fund. This will vary depending on their investment policies, as well as the risk they are willing to take on with each project. For example, some will mostly finance equipment since they represent tangible assets. Hence the importance for them to know what the funds will be used for.

Second, knowing the details of your project cost represents a planning exercise in and of itself. It ensures that all necessary resources for a successful launch have been identified and listed, without exception. The exercise also allows you a chance to contact different product and service suppliers to validate the listed costs. With a few quotes on hand, your startup cost will be much more reliable. On another note, with your supplier research already done, the project roll-out will be that much easier because of it. Another reason that detailing your project cost is a planning exercise. To establish your project cost, simply ask yourself: What resources do you need to make it happen? Make sure to make a comprehensive list. You’ll be surprised to see what by thinking about it thoroughly, some unexpected elements will pop to the surface, which is precisely the goal of the exercise.

Make realistic financial projections

Although understanding your project cost is important, it won’t be enough to convince a funder. You’ll also have to know your potential for profitability. To demonstrate that their projects are viable and profitable, entrepreneurs should be able to estimate their operation costs as well as their sales revenues. While estimating your operation costs can be relatively simple process, it gets more complicated from there when it comes to sales estimations. Different methods exist to estimate sales, but we won’t go over them in detail in this post. Here, let’s simply retain the importance of realism. Many entrepreneurs try to demonstrate their strong business project potential by projecting gigantic sales. While they believe they’ll leave funders salivating at the opportunity, such an approach will instead make they lose all credibility. What you have to understand is that entrepreneurial funders have evaluated hundreds of business projects. They have seen it all, and know that chances of the next Facebook are slim. With more modest projections, entrepreneurs instead show the realism of their project and their process.

Know who you are talking to

It’s not rare for entrepreneurs to ask for funds they simply won’t be able to obtain. While the battle is already lost, they stubbornly try to ask for them anyway. It’s a classic mistake that is often made at the financing stage. The problem resides in the fact that many entrepreneurs take financing refusals personally. They automatically fall into debate mode and try to convince the funder to finance their project. What is important to understand is that not all funds are targeted to all projects! Some funders reject certain projects in advance based on their business sector, their size, their stage of development, or even their level of innovation. You therefore need to know what doors to knock on, as well as avoid wasting time on funds that simply can’t be obtained to finance the project in question. Before applying for financing, you’ll need to study the entrepreneurial ecosystem.

Which funders exist in your community? How much financing do they give annually? What projects were financed by them last year? What are their eligibility criteria for funding? You then need to have an honest discussion with your advisor on your actual chances of getting financing for your project.

For example, at Futurpreneur Canada, we’re proud to have a democratic philosophy to entrepreneurship. Our start-up financing is one of the least restrictive in Canada, allowing all types of viable projects to come to light. Annually, our program offers financing to over 1,000 new businesses across the country.

Relax, a refusal is rarely final!

Since starting out in economic development, I’ve worked with over 80 different start-up funders. And few would refuse to reconsider a project in the future if its situation has improved. This said, not many entrepreneurs readily accept a refusal when it comes to financing. They try to change the decision right away because they don’t want to adjust their launch schedule.

If you face a refusal, I have one piece of advice: take a deep breath!

It’s highly probably that this refusal turns out to be a blessing! In economic development, coaching and financing are parts of a same whole. If you project didn’t receive financing, it’s probably because your business model needs some work or a complete overall. By taking note of the reservations voiced by funders to explain the refusal, you can then take charge of the risk management for your project. While it can be a hard moment for your ego, going back to the drawing board will be beneficial to your entrepreneurial journey. This said, it’s rarely what we want to hear when someone declines our request.

Financing is a process

The financing step is not instantaneous. It’s a process which requires a certain amount of planning. As you can understand, financing your business project will need time, patience, and especially deep reflection on the project.

By accepting from the start that financing and coaching support are inseparable, you’ll truly reap many benefits from this essential step, which will power you up rather than slow you down.

To find out more about start-up financing at Futurpreneur Canada, click here.

Written By: Jean-Philippe L’Écuyer, Entrepreneur in Residence, Futurpreneur Canada, jplecuyer@futurpreneur.ca

The Yang of Profitability: Managing Costs

Can proper management of costs alone guarantee profitability and business success? Of course not! Profitability involved both proper cost management as well as creating value for the client. Interdependent and part of a whole, managing costs and creating value are the Ying and the Yang of business profitability. To find out more on creating value for the client, check out The Ying of Profitability: Creating Value.

That being said, poor cost management has too often caused a high-potential project to fail. This blog post focuses on this second key element to profitability, namely cost management. Let’s take a closer look at different cost factors and their potential impact on your business project profitability.

Your project cost

When the time comes for you to choose a place to live, you’ll naturally ask yourself how it will fit within your monthly budget, right? A downtown condo in Montreal or Toronto won’t cost as same as an apartment in the suburbs. The same principle applies when buying a car. You’ll ask yourself if the purchase will be manageable with your budget, or if the cost will crush you (and your finances).

The same logic should apply to your project costs. A project costing $250,000 will make it more difficult to turn a profit than one with a $5,000 cost. While it is true that your project cost will eventually be capitalized as assets (in accounting terms), it will directly impact your operations costs.

While figuring out the cost of your project, make sure you evaluate multiple option. For each of these options, calculate the monthly operating cost and the volume of sales needed to cover the total cost. You’ll quickly realize that it’s best to choose the less costly options when starting out so you can be profitable as quickly as possible.

Let’s be clear here, the idea isn’t to kill your overall business vision, but to make it happen step by step by quickly reaching your beak-even point. I highly suggest doing the exercise of converting your project cost into a monthly budget; the result might surprise you!

Fixed costs vs. variable costs

Let’s look at an example. Say Jonathan produces video. He’s just secure a new, one-month contract, but he needs to acquire specialized equipment to produce it. Which of these two options is the most cost-effective for him?

Option 1: Buying the equipment by taking out a loan that will cost him $240 a month for a two year period.

Option 2: Rent the equipment at $500 a month

If you’ve answered Option 1, you are unfortunately in the wrong. Consider that Jonathan needs this piece of equipment to fulfill this specific contract, but probably won’t need it afterwards. Instead of buying the equipment and adding a $240 monthly cost to his operating costs, he should only spend $500 once to execute this contract.

At times, it’s necessary to choose the more costly option, based solely on the fact it’s a more flexible one. In Jonathan’s case, renting the equipment only when he needs it will cost him more than twice the monthly cost compared to purchasing the equipment. However, by choosing the renting option, he won’t have anything to pay when he doesn’t require the equipment. Over the full year, renting becomes more cost effective for him. It might seem counter-intuitive, but the more costly option on a monthly basis is actually the most cost-effective.

One day, Jonathan will have enough of these types of contracts to justify buying the new equipment. But for now, it’s not the case. The question then becomes, when would be a good time for him to buy the equipment?

To find the answer, you’ll have to ask yourself: how often does the equipment have to be used to justify its purchase?

Option 1 – Purchase: $240 a month = $2,680$ a year

Option 2 – Rent: $500 a month = $3,000 for 6 months

This calculation shows that after 6 full months of use per year, purchasing the equipment becomes the better choice for Jonathan. As long as he doesn’t have enough of these contracts to use the equipment up to 6 months of the year, renting it remains the best choice in terms of profitability.

You can do the same exercise for your business. What fixed costs can be converted to variable costs? Could I rent a space on a daily basis instead of having a lease? Could I hire freelancers instead of employees? Could I rent a software on a monthly basis instead of purchasing it? Establish a budget for each option which relate to your business.

Planning for long-term profitability

The founders of Enzymes Juices initially distributed their products themselves, since it allowed them to save on distribution costs (see article here). Eventually came the time when they had to start selling through a distributor. They then had to face a major issue: their sales price no longer covered their expenses. They had no choice but to raise their sales price, which had a negative impact on their volume of sales in the short term. What lesson can be drawn from that experience? The founders of Enzymes said it themselves, better to plan for your long-term costs when the time comes to set your sales price.

By focusing only on current costs, you risk negative impacts on your business profitability in the mid to long term. It’s therefore important to consider profitability on a longer-term basis and to see which resources you’ll need soon. Planning and profitability are true soul mates. You can separate one from the other!

Getting help with business planning

I’ve now outlines a few elements to take into consideration for the profitability of your start-up. These factors are universal to all types of businesses, so you can count on them having an impact on yours. However, it can be a good move to ask a professional to do a full evaluation to determine the profitability potential of your business project. Don’t hesitate to reach out to a start-up coach to ask for help with your planning!

Written By: Jean-Philippe L’Écuyer, Entrepreneur in Residence, Futurpreneur Canada, jplecuyer@futurpreneur.ca

The Ying of Profitability: Creating Value

While some businesses struggle to achieve a small 2% profit rate, others manage to easily surpass the 18% net profit margin. Why is that exactly? What makes a business more profitable than the next? Is it linked mostly to proper management of operation costs or is there more coming into play?

When starting out, these questions can keep entrepreneurs up at night. While they are ready to take the leap, they wonder if the journey will be worth it financially. They also want to ensure they’ll have all the key elements in place to optimize the profitability of their business project.

So, how do you build a business that will truly be profitable? Here’s the first of two blog posts on the subject, which, I hope, will help you fill your entrepreneurial toolbox.

As with the Ying and the Yang, creating value and managing costs are interconnecting parts to business profitability. This first blog will focus on one of these two key elements: creating value.

The myth of the profitable sector

First off, let’s start by breaking a myth. Some entrepreneurs wrongly believe that some business sectors or industries are more profitable than others. But that’s not the case.

It could be tempting to assume, for example, that the tech industry could be more profitable than the restaurant industry. That said, industry does not guarantee business profitability. Profitability depends on the business project, and not the sector or industry. Dealing with deficit is entirely possible in the tech industry, just as is making a profit in the restaurant industry.

A business’s profitability relies more on the strength of the business project which informs the creation of said business. A business project encompasses many elements, such as its market, its business model, its innovation or its promoter, meaning you, the entrepreneur. A business project also fits within a specific timeline, which means a business project with a high profitability potential today might not have the same potential tomorrow. The concept of time is therefore crucial to its profitability potential.

The goal here is not to elaborate on the building blocks of a business project, but rather to give you some areas to think about when it comes to factors influencing business profitability. Remember that profitability is linked to the business project as a whole. Here though, we’ll be taking a closer look to some specific profitability factors.

Your sales price

It goes without saying that profit is calculated by subtracting the total operating costs from the sales revenues. All entrepreneurs understand this simple equation. However, most entrepreneurs don’t realize the importance of having the right sales price to optimize their profitability. Most settle for selling at the same price as their competitors.

But to maximize profitability, you need to complete a comparative analysis of the competitors’ prices. This means you’ll need to identify what price all your competitors are selling for, but also highlight the value they bring to the consumer in each specific case. In other words, you’ll need to ask yourself the following questions: What does my competitor offer the client for the same price? What tangible benefits does the client derive from the product? Can they find the same benefits elsewhere? At what price?

When you ask yourself these question, you can make the connection between what you offer and the value it brings to the client. In the end, what’s bankable is not your offer; it’s what benefits your client can take away from it.

Being aware of the benefits associated to your offer will allow you to charge for their true worth. There must be something specific to your product or service which justifies a more appealing price for you as an entrepreneur. So then, what feature is unique to you? What specific value do you bring to your client?

Your business model

Profitability is not only about your sales price. Another important variable also comes into play: your business model.

What level of service will you be offering your client? What distribution channels will you be using for your product or service? Who will pay for your product or service? Will you have different rates for different types of clients? Which of these customer bases will be the most profitable? How will your product be produced?

These are only a few of the questions which will help you uncover the underlying business model to a project. All the elements have an impact of your business profitability.

For example, if you are alone in offering a certain product or level of service, you’ll have more flexibility to generate more substantial profits. On another level, if your business model allows you to bypass a more traditional distribution system, you’ll be able to make a profit where your competitors will need to cover costs.

In other words, it pays to have an innovative business model! You’ll just need to take the time to design it well and consider different option instead of sticking to your first idea.

Creating value, your first ingredient!

As I’m sure you’ve understood, profitability happens through creating value for the client. This value, which is built upon your business model, will then have repercussions on your sale price. But let’s not forget that profitability is not only about creating value for the client. You also have to manage your costs effectively!

The second part of this blog will explore how to tackle the costs associated with your business to boost profitability. Don’t miss The Yang of profitability: Managing costs in the upcoming weeks.

Written By: Jean-Philippe L’Écuyer, Entrepreneur in Residence, Futurpreneur Canada, jplecuyer@futurpreneur.ca

The Importance of Financial Literacy

Written By: Alex Tveit, Vice President, Morrison Financial

There are some key pillars that are important when you are creating the foundation for your business. You need to understand the initial legal framework where you are operating, you need to understand your market, and you need to understand your numbers.

It is easy to get caught up in focusing on your business idea. After all, it’s your passion for your idea, or how you can commercialize it, which has helped you make the ambitious move towards becoming an entrepreneur. While there is nothing wrong with this focus, it could be fatal if you forget to make sure that the foundation of your business is robust.

Understanding your numbers is key in understanding your business

Even if you outsource your bookkeeping, or if you have an accountant in house, it is still important that you have some fundamental financial literacy. Without understanding the key numbers making up your business, the hurdles for Canadian entrepreneurs are more difficult to maneuver across.

“The biggest cited regret by failed entrepreneurs is that they did not pay enough attention to learning how to track and manage finances in their first year. “

A study conducted by Intuit Canada showed that one in three business owners underestimated the amount of time they would spend on financial management. Over half those surveyed did not use an electronic or cloud-based software, but rather resorted to keeping track of their finances by hand.

What are the implications of having weak financial literacy?

While some of the dangers of not keeping on top of your company’s financials are clear, such as not being able to track your expenses and profit accurately, some are not so apparent:

- Without a clear guide to your financials, acquiring debt or equity financing will be very difficult.

- Lack of an ability to create and understand accurate budgets and forecasts.

- It leaves you prone to risks from dealing with variable costs, such as exposure to foreign exchange volatility.

- It could leave you missing out on grants and/or tax credits available to your business.

- It could hamper your ability to negotiate from a position of power, resulting in not being able to accurately price your product or service.

- Makes you more susceptible to look at your business through rose-coloured glasses.

What are some key areas which strong financial literacy will help your business?

First, realize that basic financial literacy is not fundamentally difficult. Even those without accounting or finance experience can relatively easily understand the basics. Also, even though the majority of Canadian SMB’s do their own financials, it is important to recognize when you need help. Accounting and legal aspects of running a business, are often areas where most entrepreneurs will need help from professionals.

Let’s look at some areas that strong financial literacy can help you with:

- If you budget/forecast for the next 12 months, it will give you an indication of where your business is headed. Regardless if you are presenting to investors and financiers, or just using them for your own purposes, it is important that your financial plan is realistic.

- It helps you create a cashflow, so that you can prepare for any capital funding needs in advance.

- It helps you assess where you may be able to delay payables. In some cases, you may be able to use credit cards by up to 55 days’ interest free. In others, you can get points to use for travel, or to put against your costs.

- It helps you understand account receivables collection, and its importance in keeping your financials healthy. It would also potentially allow you to understand instances were credit insurance on your receivables would be beneficial.

- It helps you measure, and make more effective, key metrics of your business, such as inventory turnover.

- It helps you understand the language of investors and financiers, which in turn makes you able to negotiate better terms. It also helps you understand reporting requirements once you have acquired financing.

Sometimes all the different aspects of running a business can seem overwhelming. While rewarding it can be tough, especially if you are working by yourself. What you as an entrepreneur must realize, is that you are not on an island by yourself. There are resources available to you to take advantage of. From mentorship arrangements through organizations such as Futurpreneur, to topic specific workshops and seminars held by experienced organizations. Most of us realize that the only way we can foster a great economy in Canada, is through supporting entrepreneurs, and helping create a great foundation for them to prosper in.

The Pension Question: Whither CPP Expansion?

Written By: Brett Hughes, Business Writer, CFIB

For a start-up business owner, meeting payroll may not be your immediate concern, given that your business is just getting off the ground.

A slate of full-time employees might come a few years down the road, once you’ve firmly established your business model and taken some steps towards scalability, and, ideally, profitability.

Yet payroll stands to become a significant line item on your accounting ledger. In fact, for many companies, payroll is the largest expense for the business.

It’s not a surprise that many small business owners are paying very close attention to the current debate over the plan to expand the Canada Pension Plan (CPP).

Nine of 10 provincial finance ministers, along with the federal government, have signed an agreement in principle to expand CPP (Quebec has yet to sign the agreement, pending further review of its plan in the fall ). In order to expand CPP, the federal government needed the support of at least seven of 10 provinces, representing two-thirds of Canada’s population.

Beginning in 2019, workers and employers will see their CPP contributions go up. Although the details are still emerging, the reform will see pension benefits increase from 25% of income to about 33% of income. Employer and employee premiums would each rise from the current 4.95% of employees’ pensionable earnings to 5.95%.

The amount of income subject to CPP premiums will also go up: income up to $82,700 will be subject to CPP contributions (the current threshold is $54,900, expected to rise to $72,500 by 2025), although the contribution rate will be 4% on this new income bracket.

The new plan will be phased in from 2019-2025, with a July 15, 2016 deadline set to finalize the agreement in principle.

For large companies, a few extra hundred bucks here and there per employee won’t be a difference-maker. For small firms, however, a payroll tax of this nature could be the difference between profitability and purgatory.

At the very least, a mandatory hike in CPP payroll premiums stands to create uncertainty for many small businesses: some will have to cancel wage increases; some will avoid additional hiring; some will look at increasing the cost of their products and services; and others may close their doors entirely.

The Canadian Federation of Independent Business has taken the pulse of its members through surveys and the results continually show little support for CPP expansion. Over two-thirds of small businesses say they are opposed to a CPP hike.

Canadians in general don’t see additional mandatory CPP contributions as the best way to help them save for retirement: when asked, they choose RRSPs and TFSAs ahead of mandatory CPP payments.

There are a host of legitimate reasons to get behind policy that will help people afford a more comfortable retirement, yet CPP expansion is definitely not the policy that will achieve this goal.

In fact, if the goal is to assist the current cohort of seniors with their retirement savings, then CPP hikes are probably the worst way to accomplish this, since they will receive literally nothing through expanded premiums (it will take nearly 40 years for benefits to be paid out to contributors). It also bears mentioning that truly poor senior citizens won’t receive the ostensible benefit of increased CPP payments, since many of them didn’t make contributions to CPP in the first place (remember that CPP takes a percentage of a person’s working wages; people who did not regularly participate in the workforce won’t be seeing much in the way of CPP payments at 65).

There’s also the small matter of whether or not Canadians are even experiencing a “retirement savings crisis.” Depending on which source you follow, this is either overstated or a complete myth. Either way, CPP expansion in the current economic climate will prevent many small businesses from expanding, while giving prospective start-ups one less reason to launch.

If you want to explore some facts and figures associated with CPP and how it will affect you, please visit RetirementReality.ca for more information.

Did you know? As a new entrepreneur with Futurpreneur, you get a free 6-month membership with My StartUp, a program offered by CFIB that provides resources and support to new entrepreneurs? Register here.

About The Author:

Brett Hughes is a business writer for CFIB, a non-profit organization dedicated to serving Canada’s small business community. To learn about CFIB’s free membership program for first-time entrepreneurs, visit MyStartUp.ca. To read more My StartUp advice provided by Brett and other entrepreneurial-minded individuals, visit the My StartUp blog.

The Pros and Cons of Using Debt to Grow Your Business

Written By: Alex Glassey, www.AlexGlassey.com

49.3% of small business owners said that their business did not have enough money, according to my most recent survey.

In today’s world of inexpensive debt, the solution seems simple enough: Why not borrow it?

Like any powerful tool, business debt is a good news, bad news story. The good news is that properly used debt supports your business and speeds its growth. The bad news is that, used unwisely, debt can constrain or kill your business and even hurt you personally.

Here’s why.

The three things you must know about business debt

Business debt is a product like any other: the bank is simply selling you money. And like any product, it is tailored for specific uses in specific ways:

- Business debt is designed for low risk situations. Because of this, banks can provide money inexpensively relative to other kinds of business financing. But this also means that banks will only lend money when they are very sure to get repaid.

- Business debt often comes with a “security clause” to help ensure that the bank gets its money back. If the debt isn’t being repaid, the clause gives the bank the right to sell an asset belonging to the business, such as equipment, land or a building.Owners of small businesses with few assets are often asked by the business for a “personal guarantee”. In the event that the business can’t repay the debt, the bank will require the owner to repay it personally. Ouch!

- A business is obligated to repay a business debt, regardless of what might happen. This is unlike an equity investment in which the investor agrees to share the business risk with you; if things go well, investors are paid well. If things go poorly, they are paid poorly or not at all.This obligation to repay a debt comes ahead of almost all other normal business payments, including your suppliers and staff. In a crunch, laying off staff becomes “easier” than not paying a business loan.

Slow and steady wins the debt race

The wise business owner knows this and uses debt deliberately and appropriately. She is guided by these three principles:

- Don’t “spend” or “gamble” the money you get from a business loan. Invest it in something that you are reasonably certain will generate a positive return. For example, invest in equipment that will more than pay its own way by cutting production costs.Spending it on something like an unproven marketing approach is risky (see point 1 above) and inconsistent with this type of financing.

- Ensure your business has predictable cash flow that is more than enough to cover the loan payment. This, in conjunction with the investment philosophy in point A, helps protect the business from unforeseen events like slowing sales or a sharp rise in expenses.

- Respect the bank’s right to ask for security, but protect yourself personally. If the bank is asking for a personal guarantee, it may be that they are seeing business risks that you don’t. Discuss this with them thoroughly and find ways to eliminate or minimize their need for your personal guarantee.

Finally, while not directly related to business loans, it’s a great idea to practice sound cash management habits like daily cash reconciliations and monthly financial statement reviews. These disciplines help you understand how a loan will affect your business. They actually make it easier to obtain a loan. And they help you track the on-going health of any loan you do get.

If you treat business loans like I treat my 10” chef’s knife, you’ll do just fine. My knife is a very useful tool and I treat it with a healthy dose of respect.

For more tools around financial planning, visit the Futurpreneur Business Resource Centre here.

Interview with Derek MacArthur, Manager of Risk & Credit at Futurpreneur Canada: Breaking Down the Application Process

At Futurpreneur Canada, we often get questions on our application process and what our team looks for in applicants and their applications. To answer some of our commonly asked questions, I chatted with our Manager of Risk and Credit at Futurpreneur Canada, Derek MacArthur.

Derek’s role is to work closely with the other members of the credit adjudication team and with the customer relationships team to ensure that applications submitted meet the risk criteria of Futurpreneur Canada. And to ensure that applicants are best positioned for success from a risk standpoint.

Can you briefly describe the process that takes place after an entrepreneurs applies to a Futurpreneur Canada financing program?

Regarding credit adjudication, a complete review of the application is undertaken, which includes the credit covenant of applicants, viability of concept, strength of the business plan and its key components, accuracy and attainability of cash flow projections. The submission also must meet all Futurpreneur Canada core eligibility requirements.

Where BDC funding is requested, the submission must also meet the eligibility requirements of the BDC and a background check is conducted.

What does National Credit Adjudication suggest are some indicators of a strong application submission?

There are too many factors to list them all. The application as a whole and how all the components fit together determines the strength of the application.

In general however, stronger applications usually demonstrate realistic cash flow projections; with conservative sales, showing a gradual ramp up in sales volumes (and seasonality) where applicable. Costs should not be understated, and margins should be reasonable for the industry. Letters of intent, strategic alliances, and sales and supplier agreements should be sourced to shore up sales and cost models where applicable. Fixed costs should be contained to reasonable levels; the higher the fixed costs, the more difficulty a business will encounter with cash flow if sales do not materialize as projected. Businesses with high monthly rent for example, may encounter difficulty early on.

Also, the skill set of applicants is relevant to the success of the business, as the learning curve and risk for a new business owner tends to be greater when unfamiliar with the industry. Where the entrepreneurial skill set is not geared precisely to their choice of start-up, the business plan should speak to the outside consultants and support engaged to assist them as needed. The business plan should give careful consideration to the “what if” scenario, and what alternate business strategy, sales model or product lines can allow the business to succeed if sales are not attained as expected.

How much of the application is weighted on your credit score?

Applications that do not pass our credit criteria do not qualify for our funding, hence it is core criteria and of critical importance. This is not to say however, that an application that passes our credit criteria will be automatically approved. The viability of concept and strength of file submission, and the various other eligibility criteria (in addition to credit eligibility) can also result in a file submission being deemed ineligible to our funding.

What can entrepreneurs do that don’t meet the credit requirements?

In terms of credit profile, several factors impact credit scores such as, but not limited to:

- Late payments or other derogatory information recorded on the credit bureau

- Third party collections

- Judgements

- Bankruptcy or Consumer Proposals

- A lack of credit history (AKA a thin file, which Futurpreneur deems as four reported trade lines or less)

- High credit utilization

- A high number of recent credit inquiries

These can all affect your credit profile. Futurpreneur Canada uses the Equifax consumer credit report, and while our credit scoring model with Equifax is proprietary, the factors above have a key impact on all Equifax credit scoring models. Futurpreneur Canada recommends that applicants take advantage of the Equifax Consumer Interview process to obtain more information on their personal credit profile. In order to discuss their personal credit profile with Equifax, individuals must first order and receive a copy of their consumer credit bureau which can be requested here.

Applicants may also refer to this resource on the government website on understanding your credit report and credit score.

To make sure your application is built for success, utilize some of the free resources available online from Futurpreneur Canada here.