- Futurpreneur(s) and partners

- Money and finance

Shop for a bank account and keep bank charges down

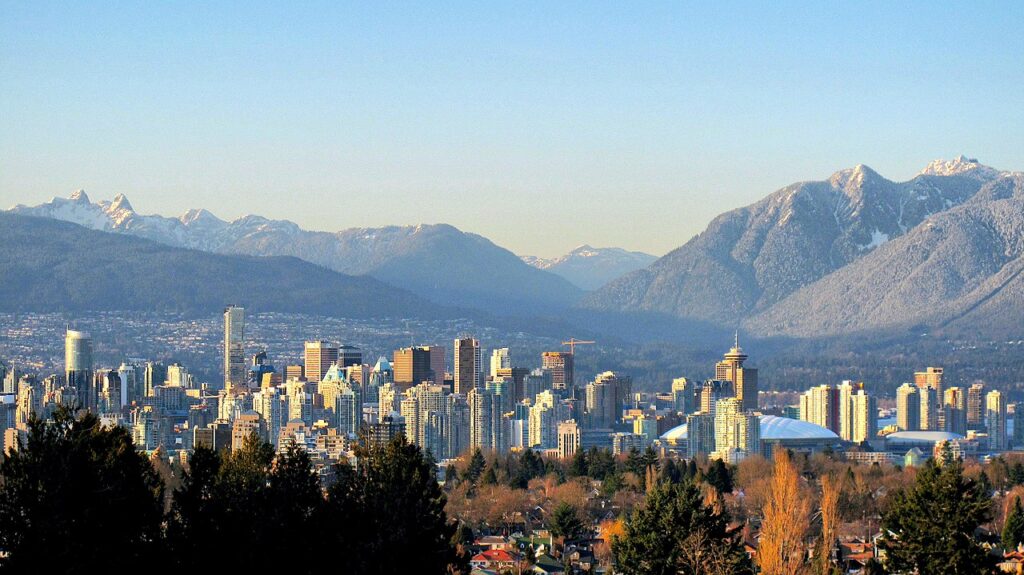

Karen Milde, Reframe Marketing, Vancouver, BC, CYBF Mentor

Before starting your search for the best bank account for you, put together a list of your requirements that you can present to the banker. This will make the selection process easier and increase the chances that you will be given more realistic options.

Among other things, your list of requirements should address:

- Number of transactions per month

- Annual fees

- Line of credit available

- Additional transaction costs

- Minimum balance

- Credit cards

- Cheques

- In-person banking services

- Online banking services

- Locations and branch sizes

- Institution’s lending authority

- Rewards

It is important to view your banking arrangements as a long-term relationship. Consider what your needs are today, and which services you may require in 18 to 24 months. Once you’ve established a relationship with your banker, meet with him or her at least once a year to offer an update on your company’s finances.

In some cases, entrepreneurs that are good at separating business expenses from personal ones choose to forego a business bank account. This may apply to you if you are not yet incorporated and a business bank account is not required.