Tax season made easy: 8 tips to help you navigate the season stress-free

Tax season giving you the jitters? Don’t worry, at Futurpreneur, we’ve got your back! Filing your taxes doesn’t have to be stressful. Whether you’re managing a side hustle, launching a startup, or growing your full-time business, getting a handle on your taxes means more money in your pocket—and no last-minute scramble.

Did you know? According to a recent survey by FreshBooks, 35% of small business owners struggle with the complexity of tax laws, and 32% have trouble identifying deductions. These uncertainties can lead to missed incentives, which can impact key business decisions, such as hiring and pricing.

Here’s the thing: With some preparation, professional help, and the right tools, you can get your taxes filed smoothly, maximize your deductions, and stay focused on what you do best: growing your business. You don’t need to be a tax expert, but working with a trusted advisor can ensure everything is handled correctly and help you avoid costly mistakes.

Here are 8 tips to help you breeze through tax season:

- Stay on top of your finances: Keep your records up to date and review them monthly. This gives you a clear picture of your revenue and expenses while reducing year-end stress.

- File your taxes on time: Avoid unnecessary penalties by ensuring your filings are submitted on schedule. A simple step that saves you money!

- Manage payroll reporting on time: Make sure your monthly payroll reports and remittances are submitted promptly to avoid penalties and keep your business operations running smoothly.

- Know your deductible expenses: Ask your advisor for a list of claimable business expenses. This will save you time and help prevent issues with the Canada Revenue Agency (CRA).

- Make taxes part of your business plan: Planning for taxes means your business is thriving! Include tax management in your strategy to stay prepared and avoid surprises.

- Find the right advisor: Your time is valuable! Instead of spending hours on bookkeeping, work with a trusted advisor who can set up the right processes—so you can focus on growing your business.

- Take advantage of available resources: The Canada Revenue Agency (CRA) offers helpful tax resources for entrepreneurs. Plus, your advisor can provide up-to-date annual tax information, and your local chamber of commerce may have helpful resources to support you through tax season.

- Know what you can (and can’t) claim: One of the biggest tax mistakes entrepreneurs make is misunderstanding deductible expenses. Get clear on what’s eligible to avoid costly corrections and wasted time.

While tax season might feel like an afterthought for many entrepreneurs, it’s actually a golden opportunity for growth. A well-managed tax plan can not only save you money but can also improve your bottom line, setting your business up for success in the future.

Need more help?

Check out Futurpreneur’s Business Resource Centre for tools and tips to keep your business growing.

Want more resources?

Visit the Canada Revenue Agency’s small business tax resources for all the info you need to file your taxes like a pro.

Buying strength, building success: Kirsten Burns’ path to business ownership with #OwnersWanted

When Kirsten Burns took the leap from manager to owner of Tri Fit Training in Airdrie, Alberta, she stepped into a new phase of her career with confidence and purpose—supported in part by Futurpreneur’s #OwnersWanted Program.

Tri Fit is a performance-focused facility offering strength and conditioning, nutrition services and massage therapy. After managing the business for five years, Kirsten officially purchased it in October 2024. For her, it wasn’t a dream years in the making—but rather the right opportunity at the right time.

From opportunity to ownership

“Business ownership wasn’t on my radar,” says Kirsten. “But after years of helping grow the business on the management side, I saw a chance to make a bigger impact.”

That chance came when the former owners offered her the opportunity to take over. Kirsten was already embedded in the business and had a deep understanding of its culture, clients and potential.

Why buying a business made sense

Rather than building from scratch, Kirsten saw the value in buying a business with an existing customer base, operations and strong community presence. It wasn’t without challenges—especially when it came to understanding finances and navigating the legal side of a share purchase.

But she wasn’t alone. From the early stages of her journey, Kirsten connected with Futurpreneur through a referral from RBC’s small business team.

Tools for confident ownership

Futurpreneur supported Kirsten with startup loan financing, a mentor and access to practical tools and resources. These supports helped her fine-tune her business plan, build scalable systems and overcome early uncertainty around revenue.

Mentorship proved especially valuable. Kirsten’s mentor helped her strengthen her social media strategy and refine how she markets within her local community.

“Identifying my strengths and weaknesses early on helped drive our conversations,” she says. “My mentor’s background in marketing helped me build confidence in areas that didn’t come naturally.”

Listen to Kirsten’s top success strategies for buying a business in this audio clip.

Alberta challenges and community strengths

Running a business in Alberta brings unique considerations—from market volatility linked to the oil and gas sector to challenges in attracting top talent. But it also presents opportunities.

“There’s a strong entrepreneurial spirit here,” says Kirsten. “And Airdrie, while growing fast, still has a small-town feel. The local support for small businesses is incredible.”

Her advice for navigating these complexities? Stay informed and surround yourself with experienced professionals who can help guide your decisions.

Lessons from experience

Kirsten’s journey hasn’t been without hurdles. Two key ones were assessing the financial health of the business and navigating the legal complexity of a share purchase.

Thankfully, she leaned on her network of fellow entrepreneurs, as well as a skilled accountant and lawyer, to feel confident she was making the right move.

She also emphasizes the importance of having a clear transition plan. Working collaboratively with the former owners helped retain staff and maintain trust with clients.

Common pitfalls to avoid

From her experience and conversations with mentors and peers, Kirsten highlights several common mistakes young entrepreneurs should avoid:

- Underestimating the time commitment required to run a business.

- Overlooking the importance of a smooth transition with staff and clients.

- Ignoring the need to manage cash flow, especially in the early days.

A new chapter, professionally and personally

Owning Tri Fit has given Kirsten more autonomy over her career but has also come with its demands. Wearing many hats has helped her grow in areas like leadership, problem-solving and decision-making.

“Being a business owner means rapid development in so many areas,” she says. “It’s been challenging—but incredibly rewarding.”

Thinking of buying a business? Here’s where to start

Kirsten encourages aspiring entrepreneurs to explore Futurpreneur’s #OwnersWanted program for insights, tools and real-world strategies to make business ownership a reality.

You can also learn more about Futurpreneur’s Startup Program, which offers startup loan financing with mentorship and resources—up to $75,000—here.

Want to learn more? Explore how #OwnersWanted helps young entrepreneurs on their journeys to purchase existing businesses in Canada.

Thank you to the Government of Alberta for supporting this initiative.

Strategies and resources to help young entrepreneurs navigate economic uncertainty

Small businesses are the heart and soul of Canada’s economy. According to Statistics Canada, there are more than 1.07 million small businesses across the country—representing approximately 98% of all businesses. Behind every local business is a passionate entrepreneur with a vision to create, build and grow. But today’s economic climate presents new challenges. Rising costs, trade uncertainties, shifting consumer habits and supply chain disruptions can add pressure to even the most resilient entrepreneurs.

At Futurpreneur, we’ve been helping young founders start, buy and grow their businesses since 1996. We know that navigating uncertainty isn’t easy, but with the right strategies, support and resources, you can set your business up for success.

Here are some strategies to help you adapt, build resilience and keep your business moving forward. And don’t forget to check out the resource list at the end to help you stay informed and ahead of the curve.

1. Source locally whenever possible

Cut down on supply chain risks by working with Canadian manufacturers, suppliers and distributors. Buying local can, in many cases, reduce costs, strengthen the economy and build strong, reliable partnerships. Whether it’s raw materials, packaging or services, investing in your local networks can help your business stay resilient.

2. Explore new markets

If your current market is slowing down, consider expanding your reach. Canada’s trade agreements with Europe, the United Kingdom and the Indo-Pacific region open doors to new customers. Whether through exports, e-commerce or partnerships, tapping into new markets can bring fresh opportunities for growth.

3. Reassess pricing and costs

Inflation and rising costs can be tough, but small adjustments can make a big difference. Reevaluate your pricing strategy, bundle products or services or introduce subscription models to create steady revenue streams. Transparent pricing that reflects value will help retain loyal customers while maintaining profitability.

4. Strengthen your digital and e-commerce presence

A strong online presence helps build a trusted brand. Whether you’re optimizing your website, improving your search engine visibility or using social media to tell your story, digital tools can strengthen your brand and grow your reach. You might also explore online marketplaces or set up direct-to-consumer channels to get your business in front of more people.

Thinking about starting, buying or growing a business? Futurpreneur’s Startup Program offers up to $75,000 in loan financing with mentorship and resources to help you succeed. Learn more here.

5. Build strong business relationships

Your business network is one of your greatest assets. Developing strong relationships with suppliers, customers and industry peers can open doors to better deals, flexible payment terms and valuable collaborations. Networking events, business associations and mentorship programs—like those offered by Futurpreneur—can help expand your connections.

6. Prioritize your well-being

A thriving business starts with a thriving entrepreneur. Make time for what helps you recharge—whether it’s exercise, reading or unplugging from work to spend time with loved ones. Running a business can be demanding but taking care of yourself is key to sustaining long-term success.

7. Stay informed and plan ahead

Economic conditions evolve quickly. Keep up with industry trends, policy updates and market shifts to make informed decisions. Resources like the Canadian Chamber of Commerce, Export Development Canada (EDC) and the Business Development Bank of Canada (BDC) offer insights to help businesses navigate uncertainty.

At Futurpreneur, we stand with young entrepreneurs because small businesses are the heart of our communities and the engines of Canada’s economy. If you’re ready to start, buy or grow your business, we’re here to help with a startup loan, mentorship and resources to set you up for success. Startup your future, today! Learn more here.

Additional resources to help you stay ahead:

🔗 EDC Guide: How Tariffs Work for Business

🔗 Canadian Federation of Independent Business Tariff Guide

🔗 Canadian Chamber of Commerce – Canada-U.S. Trade Tracker

🔗 MaRS Canada-U.S. Trade Volatility Research

🔗 Supporting Canadian exporters through United States tariff challenges (Trade Commissioner)

🔗 Startup Canada Tariff Toolkit

🔗 Made in CA Directory / Submit Your Business

“Know your money and know yourself”: Financial success tips for young entrepreneurs from Shay Myers

Knowing the ins and outs of your money is a powerful step toward business success, says Shay Myers, an Ontario-based licensed financial professional and founder of Finance for the Culture. The company offers an accessible, fun approach to financial literacy, with a special focus on young entrepreneurs.

From personal journey to professional impact

Shay’s own story is a testament to the power of understanding your finances. Four years ago, she had only $200 to her name, a 476 credit score, and no savings. But after diving into financial education and learning the rules of the money game, Shay’s entire outlook—and finances—transformed: she saved $40,000 in just nine months and invested $25,000 by the end of the year. Her journey inspired her to become a licensed financial professional, empowering others to make the same changes. “I wanted to help people understand how money works so they could make real, lasting changes,” Shay says.

In this guest blog post, Shay shares her top tips from her recent Master Your Money workshop hosted by Futurpreneur, where she offered valuable advice to help young entrepreneurs better understand financial fundamentals and build a solid money mindset.

Start with the basics: Your budget

If you’re reading this, it’s NOT too late to get your money right! We often know more about the financial moves of celebrities than we do about our own, and that has to change. The only way to know how well you’re doing financially is to dig into your numbers—because in the wise words of Drake, “know yourself.”

A budget is more than a list of things you can’t buy. Today’s budget is elevated. It’s an outline of your income and expenses, giving you a clear view of where your money is going. It’s your financial plan that helps you tell your money where to go rather than wondering where it went.

Most people cringe at the word “budget,” imagining restriction and guilt, but the truth is, a personalized budget can give you financial freedom. Knowing your numbers is the first step toward building financial confidence and making better decisions for your future.

Personal finance: It’s all about cash flow and credit

On the personal finance side, it’s crucial to know how your money is moving. Understanding your cash flow (the money left after paying bills) helps you adjust your spending habits. If your income can’t support both your bills and the lifestyle you want, something has to change.

Your credit score also plays a huge role in your financial life. Knowing your credit score allows you to make smarter decisions about managing debt. For young Black entrepreneurs, this is especially important. If your business doesn’t yet have established credit, lenders will look at your personal credit when deciding whether to loan you money. A solid personal credit score shows financial reliability, making it easier to secure the capital you need to grow your business.

Quick guide to knowing your personal finances:

- Income: What are your main sources of income? Do you have side hustles? Is it enough to sustain your lifestyle?

- Expenses: What are your fixed and variable monthly expenses?

- Debt: What’s your total debt? How much do you owe monthly, and at what interest rate? Are you seeing progress in paying it down? What’s your credit score?

- Savings: Do you save each month? How much do you have in savings? Is it earning interest? Do you have an emergency fund that can cover at least six months of expenses?

- Investments: Do you invest? Where are your investments, and what are they earning? Are they aligned with your long-term financial goals?

Business finance: Track everything from Day One

Whether your business is new or established, tracking your business finances is key to growth. Potential lenders and investors want to see what you’ve done so far—your revenue, expenses, and plans. Knowing your business numbers not only helps you stay on track but also positions you for success when applying for grants or investments.

Essential business finance questions:

- Revenue: How much does your business make each month?

- Expenses: What are your fixed and variable business expenses?

- Profit: Are you operating at a profit (in the green) or a loss (in the red)?

- Marketing: How much do you spend on marketing, and is it driving growth?

- Delegation: What’s the cost of outsourcing or delegating tasks?

- Projections: What’s your projected revenue for next year?

Even in the early stages, knowing your business numbers can make all the difference. Grant judges and investors will want to know how well you’ve managed your income and expenses and how you plan to use any additional funding. They’ll also want to see your business plan, including your financial projections for the next 3-5 years.

Personal and business finance go hand-in-hand

Your personal finance habits often spill over into your business. If you’re disorganized with your personal finances, that will likely carry into how you manage your business finances. You can’t just wipe the slate clean by starting a business. Building strong money habits now will benefit both your personal and business financial success.

In short, get to know your numbers, and you’ll know yourself better as an entrepreneur. Because YOLO? That’s not the motto when it comes to your finances.

Ready to take control of your finances?

There are so many resources available to help you gain financial confidence. If you’re ready to take your finances to the next level, explore free tools and templates from Futurpreneur’s Business Resource Centre. Check out our cash flow templates, including a BESP-specific template designed for Black entrepreneurs.

And for more on Shay’s financial literacy work, visit Finance for the Culture. Stay tuned for details on upcoming Futurpreneur events and Master Your Money workshops to keep building your financial know-how. For a deeper dive into these personal finance basics, Shay recommends Investopedia’s Personal Finance Checkup as a helpful resource.

E05 Demystifying business loans: Why would I need them?

Tune into our new podcast, Startup + Prosper! Our podcast is dedicated to the key elements of the entrepreneurial mindset, with a particular focus on the current state of Black entrepreneurship in Canada. Each of the episodes aims to inspire and educate listeners about Black-owned businesses and their reality while providing more insight into Futurpreneur’s goals to grow, learn and help address the disparities faced by the BIPOC entrepreneurial community. Read their stories, listen and subscribe to our podcast, Startup + Prosper:

E05 – Demystifying business loans: Why would I need them?

What’s in a business loan, really? Kettie Belance, account manager at RBC― also an entrepreneur, professional singer, mother and all-around passionate person― gets to the nitty-gritty. Her role, she explains, is to provide guidance, backed by over 20 years of experience working at RBC and her own entrepreneurial journey.

“We need to make sure that our dreams come true”, said the account manager, after quoting Harriet Tubman, who famously said, “every great dream begins with a dreamer” . “Then, we must make it happen, and a great way to begin is to get help, and information on how to go about it.”

Lending a hand

A loan can open so many impactful possibilities for Black entrepreneurs. However, stigma lingers around borrowing money, credit, and the lack of financial literacy. “Knowledge is power” , declared Belance, who is committed to changing the mentality. “With that, you can make better choices, see for yourself, your family, and everybody around then you become an ambassador », she said.

And you don’t have to go through it alone. The account manager recommends getting the bank involved in the process as early as possible. « The earliest you get your banker involved, the earliest we can help you plan », she explains. Your financial partner can explain what is needed to get approval for a loan and how to go about it.

That’s not the only thing they can do for you. The advice comes in many forms. « Maybe I could advise you with an accountant, with somebody who does specialize in financial planning or investing, there are there are so many partners that can be part that could like surround your project the most of the people are not aware », she details.

Go and get it

Do you need money to make money? What you actually need is financing, explains Belance. « The business owner needs to have money that they s going to inject into the business », she explains, comparing it to a baby. That is where the loan comes in handy. « if someone else is going to give you additional capital you have to also show them how much you’re willing to put into your baby, your business, your dream. »

A loan is money you borrow from a financial institution. Your counsellor can advise you on the type and the terms if can take, and what is best for your situation. And there are so many options available. « That’s why I always refer back entrepreneurs to their bank because that’s where you get all the information for the multiple products that you can have access to », recommends Belance.

To apply for financing, there is a process. And it can take longer than expected, so to not let discouragement settle. « You have to be patient, and you have to make sure that the person that’s doing the loan for you, keeps you aware of what’s going on where we’re at », she says.

As you might expect, one important element to consider is your credit history. But that isn’t the full story. « It’s very important because you decide to do financing in the financial institution and they don’t know you, the only thing that they have is your credit bureau. », she explains.

But this alone should never stop you from applying. « it’s not because you have a credit bureau that is less credible that it means that it amplifies that you’re going to be rejected », Belance underlines. « It can be explained if we can do some research we can make it look better ». Things such as your experience as a business owner will also be considered — a key element that is not known to everyone.

In all cases, the thing to do is to make the step and get the information. if you do face rejection, it does not stop there. An account manager can give you advice about how to remedy.« So, therefore, the next time you apply, we’re gonna get it », encourages Belance. The most important thing is to ask why, then not settled in discouragement, and try again. And for entrepreneurs, rejection is part of the process. And there are options. «you’re an entrepreneur, you’re gonna go through stuff, you know, I feel like just build character. But it’s easier said than done.

RBC also recently launched a new financing solution called the RBC Black intrapreneur business loans. « RBC is committed to enabling growth and wealth creation for black entrepreneurs», states Belance. « The way that we want to do that is by giving access to capital, access to experts and access to engagement in the community. », The program has no age limit and offers up to $250,000 with advantageous rates.

To know more about how RBC empowers Black Entrepreneurs, you can visit the website , and listen to the podcast episode Demystifying business loans: Why would I need them? on Spotify and Youtube.

COVID-19: New Income Support for Small Business Owners and their Employees

Today, the Canadian government announced a new support package for Canadian business owners and their employees who are affected by COVID-19. The Canada Emergency Response Benefit (CERB) will replace two previously announced benefits, the Emergency Care Benefit & Emergency Support Benefit.

The CERB will give qualified workers who have lost income due to COVID-19, including those who have reduced work hours, are caring for ill relatives or are now staying at home to care for children, etc., up to $2,000 per month for up to four months.

Details to follow over the coming days.

What we know so far

How does the CERB help small businesses?

Workers affected by COVID-19–business owners and employees alike–will have extra support to cover lost income and meet their financial obligations.

According to the Prime Minister, workers who are still employed, but are not receiving income because of COVID-19-related disruptions to their work situation, will qualify for the CERB.

Who is eligible to apply for the CERB?

Any workers who do not qualify for EI are eligible to apply, including wage workers, self-employed and contract workers.

Should my laid-off employees apply for the CERB?

Any workers who are EI eligible and have applied to that program should not apply to CERB. This benefit is for workers who would not normally qualify for EI benefits.

Anyone who has applied for the previous relief programs (Emergency Care Benefit & Emergency Support Benefit) will be automatically migrated to the new benefit and does not need to reapply.

If I have to lay off my employees, what should they do?

Those eligible for EI should still apply for their EI benefits.

What if I need to reduce my employees’ hours after the benefit is rolled out?

The CERB will be paid every four weeks for up to four months until October 3, 2020. Employees who are affected by COVID-19 can apply to the benefit once their income is interrupted.

When will the CERB be available?

The government aims to have the application portal online by April 6. Once an application is received, the expected timeline for direct deposit to an applicant’s bank account is expected to be 10 business days.

COVID-19 Resources for Small Businesses

#cta-side{display:none;}

Last updated: February 26, 2020

With constant updates related to the COVID-19 pandemic, keeping on top of all the information available can be overwhelming, especially when you’re also trying to run a small business.

Our team has collected some details on the benefits and supports available to small business owners, as well as a number of helpful resources and guides. We will continue to update these resources with new information as it becomes available.

- Financial Support to Businesses and Workers

- Access to Capital for Small Businesses

- Business Development Bank Resources

- Government Tools and Resources

- Digital Marketing and eCommerce

- Supply Chain Management

- COVID-19 – FAQs

- Regional Support Programs

Government of Canada – Overview of COVID-19 Economic Support

Financial Support for Businesses and Workers

Canada Emergency Wage Subsidy (CEWS)

- Covers up to 75 per cent (as of December 2020) of an employee’s wages for qualifying employers. Note that benefit amounts vary depending on which time period you are applying for.

- Available retroactive to March 2020; available until June 2021

- In November 2020, the federal government announced a number of changes to the program designed to make it more accessible.

Canada Recovery Benefit (CRB)

- Provides $1,000 ($900 after taxes) per two-week period to employed and self-employed individuals not entitled to EI benefits.

- Administered by the Canada Revenue Agency

- Replaced the previously-announced Canada Emergency Response Benefit (CERB)

- Recipients must reapply for each period, and can apply for up to a total of 13 two-week periods (or 26 weeks) between September 27, 2020 and September 25, 2021.

Canada Emergency Business Account (CEBA)

- Provides small businesses and not-for-profits with interest-free loans of up to $40,000 to help cover operating costs. (In October 2020, the federal government announced plans to increase this amount to $60,000.)

- Repaying the balance of the loan on or before December 31, 2022 will result in loan forgiveness of 25 percent (up to $10,000).

- Businesses must have paid total employment income of between $20,000 to $1.5 million in 2019.

- As of October 2020, eligible businesses operating through a personal bank account will also be able to apply.

- Deadline to apply is March 31, 2021.

- Businesses must apply through their current financial institution:

Canada Emergency Rent Subsidy (CERS)

- Available to eligible businesses, non-profits or charities who have seen a drop in revenue due to the pandemic

- Directly available subsidy meant to help cover commercial rent or property expenses

- Eligible expenses can be claimed up to a max of $75,000 per business location or $300,000 for all locations

- Benefits available retroactive to September 27, 2020 and will extend until June 2021.

Regional Development Agencies (RDAs)

- Regional Development Agencies provide federal funding for tourism operators, small businesses or organizations.

- The Regional Relief and Recovery Fund (RRRF), implemented by the six regional development agencies in collaboration with the national network of Community Futures Development Corporations, supports businesses that are unable to access other government relief measures. For details, see the region closest to you:

Work-Sharing Program

- Helps employers avoid layoffs when there is a temporary decrease in business activity beyond their control.

- Provides Employment Insurance benefits to eligible employees who agree to reduce their normal working hours and share the available work while their employer recovers.

- A WS agreement has to be at least 6 consecutive weeks long and can last up to 26 consecutive weeks. Employers may be able to extend their agreements up to a total of 76 weeks.

Access to Capital for Small Businesses

Business Credit Availability Program (BCAP)

- Increases the credit available to small, medium and large Canadian businesses.

- Businesses must have been generating revenues for at least 24 months.

- Businesses must work with their existing financial institution to access it.

- If their needs exceed the level of support the financial institution is able to provide, the financial institution will work alongside BDC or EDC to access additional resources available under BCAP.

- Through BCAP, BDC and EDC will provide more than $65 billion in loans and other forms of credit at market rates to businesses with viable business models.

Farm Credit Canada (FCC)

- Provides additional financing for farmers, agribusinesses and food processors.

Purchase Order Financing

- Cover up to 90% of the purchase order amount to ease cash flow to your suppliers.

Canada Small Business Financing Program

- Easier access to loans for small businesses from financial institutions by sharing the risk with lender

- Up to a maximum of $1,000,000 for any one borrower

- financial institutions deliver the program and are solely responsible for approving the loan

Business Development Bank of Canada (BDC) Resources

Business continuity plan and templates for entrepreneurs

- Templates and tools to help entrepreneurs create and maintain their business continuity plans.

How to cope with the impacts of COVID-19 on your business (video)

- Advice for entrepreneurs on how to manage their business through this crisis period.

Well-being resources for entrepreneurs

- Resources intended to offer a range of services on mental health and well-being.

Best practices for the prevention of COVID-19 in the workplace

- A guide (PDF) summarizing practical advice for preventing the spread of COVID-19 in your business

COVID-19 business-planning tools for entrepreneurs

- Tools and tips to help you map out your next steps, identify new opportunities, mitigate risk and create resilience in your company, so you can emerge strong in recovery

Government Tools and Resources

- Use this interactive tool to determine which COVID-19 supports are available to you (includes programs and services offered by federal, provincial and territorial governments)

- Questions about federal financing options? Download the Canada Business App.

- Call to Action: Canadian Manufacturers Needed to Help Combat COVID-19

- Canadian Business Resilience Network: Offered by the Canadian Chamber of Commerce, these tools and resources are designed to help small businesses during COVID-19.

- Overview of Federal Government Services for Small Business web page highlights programs and initiatives for small businesses.

Third-Party Tools and Resources

Digital Marketing and eCommerce

- Facebook: Business Resource Hub

- Google Resources to Help Small Businesses Manage Through Uncertainty

- Shopify – COVID-19 Resources for Business Owners

- Shopify Short-Term Revenue Strategies for Brick-and-Mortar Retailers Navigating COVID-19

- GoDaddy: Take your Small Business Online: A Step by Step Guide

COVID-19 – FAQs

- For questions about rent payments, employee assistance, financing options and more, see the Canadian Federation of Independent Business (CFIB) COVID-19 FAQ.

Regional Support Programs

In addition to federal support measures, each region of Canada offers special support programs for small business owners.

- Alberta

- British Columbia

- Manitoba

- New Brunswick

- Newfoundland and Labrador

- Northwest Territories

- Nova Scotia

- Nunavut

- Ontario

- Prince Edward Island

- Quebec

- Saskatchewan

- Yukon

Alberta

Government of Alberta

City of Calgary

British Columbia

Government of British Columbia

British Columbia Chamber of Commerce

City of Vancouver

Manitoba

Government of Manitoba

Manitoba Chamber of Commerce

New Brunswick

Newfoundland and Labrador

Government of Newfoundland and Labrador

St. John’s Board of Trade

Northwest Territories

Government of Northwest Territories

Northwest Territories Chamber of Commerce

Nova Scotia

Government of Nova Scotia

Nunavut

Ontario

Government of Ontario

Ontario Chamber of Commerce

City of Toronto

Prince Edward Island

Quebec

Government of Quebec

Saskatchewan

Government of Saskatchewan

Yukon

Government of Yukon

Management Commentary on Financial Results for 2019/2019

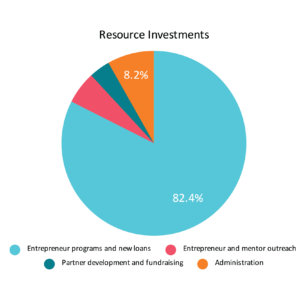

RESOURCE INVESTMENTS

At Futurpreneur, our priority is to support entrepreneurs across Canada – and to accomplish this we ensure our investments and resource allocations start with them.

Over the last three fiscal years, we have supported close to 3,000 youth-led businesses.

In fiscal 2019, new businesses that were financed through debt slowed a bit across Canada, due to rising interest rates and broader economic factors. Futurpreneur’s results also reflect this overall trend.

Futurpreneur ensures those who apply for our core Start-up Program will have access to support to start and grow their businesses. In our last fiscal year, those programs and supports represented 82 per cent of our total investment, while costs for administration were kept to 8 per cent and the remaining 10 percent was invested to build program awareness, outreach and fundraising capacity.

The average cost to deliver our core programs has increased in fiscal 2019 to reflect additional post-disbursement client support for our entrepreneurs.

More than four of every five entrepreneurs repay their loans in full, enabling their repayments to fund the next cohort of new business owners. We continue to provide strong support to our loan recipients for the five years their term loan is outstanding with us, providing flexibility to serve their needs with early redemption options and restructuring.

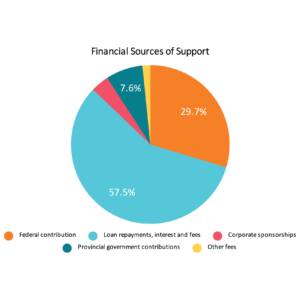

FINANCIAL SOURCES OF SUPPORT

While many not-for-profits are striving to retain current funders and identify new sources of support, Futurpreneur is prepared and well positioned to respond to ongoing demand for fundraising and partnerships. Our strength, in a large part, is due to our diversification in our sources of support. We don’t rely on any one source and have built a significant loan asset that is providing funds covering more than half of our annual cash requirements. We attract funders based on our ability to match and leverage their investments with other sources of support, and this is a strong differentiator of our model.

Several multi-year commitments for support from funders enable us to continue existing programs while also building out new resources and support to help businesses start and position for growth. To ensure a growing number of entrepreneurs will have access to loan capital, we also have a line of credit with the Business Development Bank of Canada, solely for the purpose of supporting young entrepreneurs with access to loan capital that exceeds other internal resources and sources of funds. Additional funds from the line of credit were not required in fiscal 2019, with only $4.3 million drawnat March 31, 2019 of a potential $8 million available.

Are You at Risk of Mortgage Fraud? What Entrepreneurs Need to Know

Rising interest rates and the new federal government “stress test” are making it harder for Canadians to save enough for a down payment or qualify for a mortgage compared to last year.

As a result mortgage fraud may be on the rise. A recent Equifax Canada study found that the incidence of mortgage fraud has risen 52 per cent since 2013, and that 67 per cent of all fraudulent mortgage applications in Canada originate in Ontario.

Homebuyers aren’t the only ones who commit mortgage fraud; professionals in the home buying process can profit by taking advantage of anxious buyers.

Mortgage fraud has many different faces, but generally it occurs when someone, such as a homebuyer, a mortgage broker, a real estate agent or a lawyer, misrepresents, intentionally withholds facts, lies or exaggerates information to obtain a mortgage that would not have been granted if information had been accurate.

Self-employed, independent contractors, business-for-self, part-time and temporary workers are at greater risk of mortgage fraud.

That’s because it’s often more difficult for them to prove their income, employment status and employment length, as they may not have access to the traditional proof of income documents such as pay stubs and a letter of employment typically provided by an employer.

Independent contractors, business-for-self and self-employed workers particularly, have more difficulty showing the viability and stability of their income source from the past two years. In cases where these workers are not able to provide satisfactory income proof, the impulse to fake or falsify these documents, either themselves or alongside a home buying professional, might lead to trouble.

Protect Yourself

Self-employed, independent contractors, business-for-self, part-time and temporary workers can take steps to protect themselves and ensure they get off to the right start in their new home.

- Familiarize yourself with the mortgage application process, so you know what to expect.

- Be sure to shop around for a mortgage, so you find the most suitable mortgage option for your needs and lifestyle.

- Consider using a licensed mortgage professional to help you understand your mortgage options.

- Make sure you complete the mortgage application carefully and check that all the information is correct.

- Get everything in writing and get copies of all signed documents.

- Don’t submit fake paperwork to get approved for a loan, even if a home buying professional completes the paperwork.

- Don’t trust a verbal offer for a loan, with no documents to back it up.

- Beware of being offered money to choose a certain lender or broker.

- Don’t pay cash for anything in the home buying process. All payments should be by cheque or other payment method that isn’t cash.

- Make sure you receive a lender-stamped commitment letter that has the lender’s logo and explains the conditions of the mortgage, and that you’ve complied with all conditions such as getting a home appraisal at least two weeks before closing.

- Don’t allow anyone to pressure you to sign a mortgage contract before the 48-hour “cooling off” period. You may choose to waive the “cooling off” period if there is less than 48 hours available.

- Ignore “too good to be true” offers – promises that you can get a bigger loan or a low interest rate, especially if you’ve already been declined by other lenders.

- Get an independent lawyer to review everything.

Be aware of the consequences

If you commit mortgage fraud, there may be serious consequences. If you’re caught before the mortgage loan is advanced:

- you may have already left your former home, and now you don’t have a home to move into.

- the lender could cancel the loan, which could cause the seller to sue you or you could lose your deposit.

If fraud is detected after you have the home:

- the lender has the right to “call in” the loan and require you to pay the whole amount of the mortgage immediately. If you can’t pay, you will lose the home through foreclosure or power of sale.

- your credit score will be damaged, making it very difficult for you to get a mortgage or other loan in the future.

How to report possible mortgage fraud

If you suspect fraudulent mortgage activity, first report it to your local police or the Canadian Anti-Fraud Centre. If you wish to remain anonymous, you can submit a tip to Crime Stoppers.

You can also report suspected mortgage fraud to FSCO. To learn more about mortgage fraud and how to report it, visit www.fsco.gov.on.ca/mortgage-fraud.

Article provided by the Financial Services Commission of Ontario.

Sources:

Equifax Canada, January 2017. Mortgage Fraud on the Rise; 13% of Canadians Say ‘a Little White Lie’ is Okay to Get the House You Want.

Tools & Tip: How Difficult is it to Find Financing for your Business Project?

While many entrepreneurs easily find a way to self-fund their business project from the get-go, it’s inevitable they will eventually have to inject additional funds into their project at one point or another. Financing is a key step for a start-up. It divides up stillborn project from those who will surpass the crucial five-year mark. That said, many entrepreneurs see financing as quite the puzzle and have a lot of questions that stay unanswered.

How can I get financing for my project? Who should I apply to for financing, and how to go about doing that? How do I convince funders to get on board? If I get declined, is it a definitive answer? What can I do to prepare myself well before starting the process?

In the end, is it that complicated to get financing for your project? The answer to that is: NO!

I assure you, the process is actually a lot simpler than you think. To help you with this crucial stage in your business launch, here are a few tips.

Know your project cost inside and out

I’ll never say this enough, the entrepreneur needs to become an expert when it comes to his or her project cost. As the architect of their business project, they are the only one who can speak to its overall cost. More importantly, the entrepreneur should be able to explain their project cost in detail. There’s the key, really! But why is it so important to know your project cost in detail? For two main reasons. First, funders will want to know how the funds will be used. In other words, they will want to understand how their money will be spent. It is important to understand that certain funder have restrictions when it comes to what they can and what they cannot fund. This will vary depending on their investment policies, as well as the risk they are willing to take on with each project. For example, some will mostly finance equipment since they represent tangible assets. Hence the importance for them to know what the funds will be used for.

Second, knowing the details of your project cost represents a planning exercise in and of itself. It ensures that all necessary resources for a successful launch have been identified and listed, without exception. The exercise also allows you a chance to contact different product and service suppliers to validate the listed costs. With a few quotes on hand, your startup cost will be much more reliable. On another note, with your supplier research already done, the project roll-out will be that much easier because of it. Another reason that detailing your project cost is a planning exercise. To establish your project cost, simply ask yourself: What resources do you need to make it happen? Make sure to make a comprehensive list. You’ll be surprised to see what by thinking about it thoroughly, some unexpected elements will pop to the surface, which is precisely the goal of the exercise.

Make realistic financial projections

Although understanding your project cost is important, it won’t be enough to convince a funder. You’ll also have to know your potential for profitability. To demonstrate that their projects are viable and profitable, entrepreneurs should be able to estimate their operation costs as well as their sales revenues. While estimating your operation costs can be relatively simple process, it gets more complicated from there when it comes to sales estimations. Different methods exist to estimate sales, but we won’t go over them in detail in this post. Here, let’s simply retain the importance of realism. Many entrepreneurs try to demonstrate their strong business project potential by projecting gigantic sales. While they believe they’ll leave funders salivating at the opportunity, such an approach will instead make they lose all credibility. What you have to understand is that entrepreneurial funders have evaluated hundreds of business projects. They have seen it all, and know that chances of the next Facebook are slim. With more modest projections, entrepreneurs instead show the realism of their project and their process.

Know who you are talking to

It’s not rare for entrepreneurs to ask for funds they simply won’t be able to obtain. While the battle is already lost, they stubbornly try to ask for them anyway. It’s a classic mistake that is often made at the financing stage. The problem resides in the fact that many entrepreneurs take financing refusals personally. They automatically fall into debate mode and try to convince the funder to finance their project. What is important to understand is that not all funds are targeted to all projects! Some funders reject certain projects in advance based on their business sector, their size, their stage of development, or even their level of innovation. You therefore need to know what doors to knock on, as well as avoid wasting time on funds that simply can’t be obtained to finance the project in question. Before applying for financing, you’ll need to study the entrepreneurial ecosystem.

Which funders exist in your community? How much financing do they give annually? What projects were financed by them last year? What are their eligibility criteria for funding? You then need to have an honest discussion with your advisor on your actual chances of getting financing for your project.

For example, at Futurpreneur Canada, we’re proud to have a democratic philosophy to entrepreneurship. Our start-up financing is one of the least restrictive in Canada, allowing all types of viable projects to come to light. Annually, our program offers financing to over 1,000 new businesses across the country.

Relax, a refusal is rarely final!

Since starting out in economic development, I’ve worked with over 80 different start-up funders. And few would refuse to reconsider a project in the future if its situation has improved. This said, not many entrepreneurs readily accept a refusal when it comes to financing. They try to change the decision right away because they don’t want to adjust their launch schedule.

If you face a refusal, I have one piece of advice: take a deep breath!

It’s highly probably that this refusal turns out to be a blessing! In economic development, coaching and financing are parts of a same whole. If you project didn’t receive financing, it’s probably because your business model needs some work or a complete overall. By taking note of the reservations voiced by funders to explain the refusal, you can then take charge of the risk management for your project. While it can be a hard moment for your ego, going back to the drawing board will be beneficial to your entrepreneurial journey. This said, it’s rarely what we want to hear when someone declines our request.

Financing is a process

The financing step is not instantaneous. It’s a process which requires a certain amount of planning. As you can understand, financing your business project will need time, patience, and especially deep reflection on the project.

By accepting from the start that financing and coaching support are inseparable, you’ll truly reap many benefits from this essential step, which will power you up rather than slow you down.

To find out more about start-up financing at Futurpreneur Canada, click here.

Written By: Jean-Philippe L’Écuyer, Entrepreneur in Residence, Futurpreneur Canada, jplecuyer@futurpreneur.ca

The Yang of Profitability: Managing Costs

Can proper management of costs alone guarantee profitability and business success? Of course not! Profitability involved both proper cost management as well as creating value for the client. Interdependent and part of a whole, managing costs and creating value are the Ying and the Yang of business profitability. To find out more on creating value for the client, check out The Ying of Profitability: Creating Value.

That being said, poor cost management has too often caused a high-potential project to fail. This blog post focuses on this second key element to profitability, namely cost management. Let’s take a closer look at different cost factors and their potential impact on your business project profitability.

Your project cost

When the time comes for you to choose a place to live, you’ll naturally ask yourself how it will fit within your monthly budget, right? A downtown condo in Montreal or Toronto won’t cost as same as an apartment in the suburbs. The same principle applies when buying a car. You’ll ask yourself if the purchase will be manageable with your budget, or if the cost will crush you (and your finances).

The same logic should apply to your project costs. A project costing $250,000 will make it more difficult to turn a profit than one with a $5,000 cost. While it is true that your project cost will eventually be capitalized as assets (in accounting terms), it will directly impact your operations costs.

While figuring out the cost of your project, make sure you evaluate multiple option. For each of these options, calculate the monthly operating cost and the volume of sales needed to cover the total cost. You’ll quickly realize that it’s best to choose the less costly options when starting out so you can be profitable as quickly as possible.

Let’s be clear here, the idea isn’t to kill your overall business vision, but to make it happen step by step by quickly reaching your beak-even point. I highly suggest doing the exercise of converting your project cost into a monthly budget; the result might surprise you!

Fixed costs vs. variable costs

Let’s look at an example. Say Jonathan produces video. He’s just secure a new, one-month contract, but he needs to acquire specialized equipment to produce it. Which of these two options is the most cost-effective for him?

Option 1: Buying the equipment by taking out a loan that will cost him $240 a month for a two year period.

Option 2: Rent the equipment at $500 a month

If you’ve answered Option 1, you are unfortunately in the wrong. Consider that Jonathan needs this piece of equipment to fulfill this specific contract, but probably won’t need it afterwards. Instead of buying the equipment and adding a $240 monthly cost to his operating costs, he should only spend $500 once to execute this contract.

At times, it’s necessary to choose the more costly option, based solely on the fact it’s a more flexible one. In Jonathan’s case, renting the equipment only when he needs it will cost him more than twice the monthly cost compared to purchasing the equipment. However, by choosing the renting option, he won’t have anything to pay when he doesn’t require the equipment. Over the full year, renting becomes more cost effective for him. It might seem counter-intuitive, but the more costly option on a monthly basis is actually the most cost-effective.

One day, Jonathan will have enough of these types of contracts to justify buying the new equipment. But for now, it’s not the case. The question then becomes, when would be a good time for him to buy the equipment?

To find the answer, you’ll have to ask yourself: how often does the equipment have to be used to justify its purchase?

Option 1 – Purchase: $240 a month = $2,680$ a year

Option 2 – Rent: $500 a month = $3,000 for 6 months

This calculation shows that after 6 full months of use per year, purchasing the equipment becomes the better choice for Jonathan. As long as he doesn’t have enough of these contracts to use the equipment up to 6 months of the year, renting it remains the best choice in terms of profitability.

You can do the same exercise for your business. What fixed costs can be converted to variable costs? Could I rent a space on a daily basis instead of having a lease? Could I hire freelancers instead of employees? Could I rent a software on a monthly basis instead of purchasing it? Establish a budget for each option which relate to your business.

Planning for long-term profitability

The founders of Enzymes Juices initially distributed their products themselves, since it allowed them to save on distribution costs (see article here). Eventually came the time when they had to start selling through a distributor. They then had to face a major issue: their sales price no longer covered their expenses. They had no choice but to raise their sales price, which had a negative impact on their volume of sales in the short term. What lesson can be drawn from that experience? The founders of Enzymes said it themselves, better to plan for your long-term costs when the time comes to set your sales price.

By focusing only on current costs, you risk negative impacts on your business profitability in the mid to long term. It’s therefore important to consider profitability on a longer-term basis and to see which resources you’ll need soon. Planning and profitability are true soul mates. You can separate one from the other!

Getting help with business planning

I’ve now outlines a few elements to take into consideration for the profitability of your start-up. These factors are universal to all types of businesses, so you can count on them having an impact on yours. However, it can be a good move to ask a professional to do a full evaluation to determine the profitability potential of your business project. Don’t hesitate to reach out to a start-up coach to ask for help with your planning!

Written By: Jean-Philippe L’Écuyer, Entrepreneur in Residence, Futurpreneur Canada, jplecuyer@futurpreneur.ca

The Ying of Profitability: Creating Value

While some businesses struggle to achieve a small 2% profit rate, others manage to easily surpass the 18% net profit margin. Why is that exactly? What makes a business more profitable than the next? Is it linked mostly to proper management of operation costs or is there more coming into play?

When starting out, these questions can keep entrepreneurs up at night. While they are ready to take the leap, they wonder if the journey will be worth it financially. They also want to ensure they’ll have all the key elements in place to optimize the profitability of their business project.

So, how do you build a business that will truly be profitable? Here’s the first of two blog posts on the subject, which, I hope, will help you fill your entrepreneurial toolbox.

As with the Ying and the Yang, creating value and managing costs are interconnecting parts to business profitability. This first blog will focus on one of these two key elements: creating value.

The myth of the profitable sector

First off, let’s start by breaking a myth. Some entrepreneurs wrongly believe that some business sectors or industries are more profitable than others. But that’s not the case.

It could be tempting to assume, for example, that the tech industry could be more profitable than the restaurant industry. That said, industry does not guarantee business profitability. Profitability depends on the business project, and not the sector or industry. Dealing with deficit is entirely possible in the tech industry, just as is making a profit in the restaurant industry.

A business’s profitability relies more on the strength of the business project which informs the creation of said business. A business project encompasses many elements, such as its market, its business model, its innovation or its promoter, meaning you, the entrepreneur. A business project also fits within a specific timeline, which means a business project with a high profitability potential today might not have the same potential tomorrow. The concept of time is therefore crucial to its profitability potential.

The goal here is not to elaborate on the building blocks of a business project, but rather to give you some areas to think about when it comes to factors influencing business profitability. Remember that profitability is linked to the business project as a whole. Here though, we’ll be taking a closer look to some specific profitability factors.

Your sales price

It goes without saying that profit is calculated by subtracting the total operating costs from the sales revenues. All entrepreneurs understand this simple equation. However, most entrepreneurs don’t realize the importance of having the right sales price to optimize their profitability. Most settle for selling at the same price as their competitors.

But to maximize profitability, you need to complete a comparative analysis of the competitors’ prices. This means you’ll need to identify what price all your competitors are selling for, but also highlight the value they bring to the consumer in each specific case. In other words, you’ll need to ask yourself the following questions: What does my competitor offer the client for the same price? What tangible benefits does the client derive from the product? Can they find the same benefits elsewhere? At what price?

When you ask yourself these question, you can make the connection between what you offer and the value it brings to the client. In the end, what’s bankable is not your offer; it’s what benefits your client can take away from it.

Being aware of the benefits associated to your offer will allow you to charge for their true worth. There must be something specific to your product or service which justifies a more appealing price for you as an entrepreneur. So then, what feature is unique to you? What specific value do you bring to your client?

Your business model

Profitability is not only about your sales price. Another important variable also comes into play: your business model.

What level of service will you be offering your client? What distribution channels will you be using for your product or service? Who will pay for your product or service? Will you have different rates for different types of clients? Which of these customer bases will be the most profitable? How will your product be produced?

These are only a few of the questions which will help you uncover the underlying business model to a project. All the elements have an impact of your business profitability.

For example, if you are alone in offering a certain product or level of service, you’ll have more flexibility to generate more substantial profits. On another level, if your business model allows you to bypass a more traditional distribution system, you’ll be able to make a profit where your competitors will need to cover costs.

In other words, it pays to have an innovative business model! You’ll just need to take the time to design it well and consider different option instead of sticking to your first idea.

Creating value, your first ingredient!

As I’m sure you’ve understood, profitability happens through creating value for the client. This value, which is built upon your business model, will then have repercussions on your sale price. But let’s not forget that profitability is not only about creating value for the client. You also have to manage your costs effectively!

The second part of this blog will explore how to tackle the costs associated with your business to boost profitability. Don’t miss The Yang of profitability: Managing costs in the upcoming weeks.

Written By: Jean-Philippe L’Écuyer, Entrepreneur in Residence, Futurpreneur Canada, jplecuyer@futurpreneur.ca